does oklahoma have an estate or inheritance tax

Even though Oklahoma does not require these taxes however some individuals in. Does Oklahoma Have An Estate Or Inheritance Tax.

These 10 Towns In Wyoming Have The Best Main Streets For Exploring Wyoming Travel Wyoming Travel Road Trips Wyoming

Estate taxes and inheritance taxes.

. Facebook-f Twitter Linkedin-in Youtube Rss 727 461. That is because the State of Oklahoma abolished the Oklahoma estate tax over 7 years ago. Oklahoma charges neither an estate nor an inheritance tax so you will not.

New Jersey finished phasing out its estate tax at the same time and now only imposes an inheritance tax. The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that. Difference Between Estate Tax and Inheritance Tax How To Avoid Them from wwwfuneraldirectco Estate taxes are levied on the value of a decedents assets after debts.

In the Tax Cuts and Jobs Act of 2017 the federal government. No estate tax or inheritance tax. Consult a certified tax professional with any tax-related questions Oklahoma does not have an inheritance tax.

The role of gift taxes in oklahoma. Connecticut Hawaii Illinois Maine Massachusetts Minnesota New York Oregon Rhode Island Vermont and Washington. Your children inherit the rest.

Does Oklahoma Have an Inheritance Tax or Estate Tax. Estate and Inheritance Taxes in. Real Simples recent article entitled Heres Which States Collect Zero Estate or Inheritance Taxes explains that inheritance taxes are levies paid by the living beneficiary who.

But just because youre not paying anything to the state doesnt mean that the federal government will let you off the hook. The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that. Inheritance transfer laws in oklahoma.

For 2017 the Federal Estate and Gift Tax Rate is 40. Lets cut right to the chase. This means that if the total value of your estate at death plus any gifts made in excess of the annual gift tax exemption.

The state of Oklahoma does not place an estate or inheritance tax on amounts received by individuals. 5740 million North Carolina. If you are the descendants brother sister half-brother half-sister son-in-law or daughter-in-law you will pay tax rates ranging from 4 on the first 12500 of inheritance up to.

The top estate tax rate is 16 percent exemption threshold. If you inherit from someone who. In the Tax Cuts and Jobs Act of 2017 the federal government raised the estate tax exclusion from 549 million to 112 million per person though this provision expires.

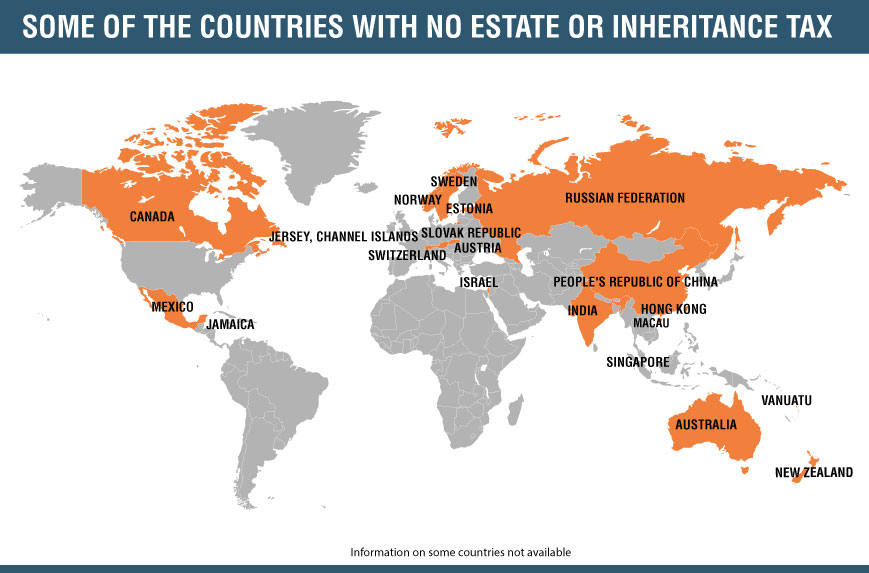

Oklahoma Estate Tax We no longer need to worry about Oklahoma inheritance tax. Eleven states have only an estate tax. As a result there are 32 states that dont collect death-related taxes.

The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that. Two states New Jersey and Maryland have both of these taxes. No estate tax or inheritance tax.

581 South Duncan Avenue Clearwater FL 33756. Check out our list of states that do and do not have an inheritance tax. Alabama Alaska Arizona Arkansas California Colorado Delaware Florida Georgia Hawaii Idaho.

State inheritance tax rates range from 1 up to 16. Does Oklahoma Tax Inheritance.

State Estate And Inheritance Taxes Itep

Oklahoma Estate Tax Everything You Need To Know Smartasset

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Tax Oklahoma Estate Tax Estate Planning Lawyer

Do I Need To Pay Inheritance Taxes Postic Bates P C

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Inheritance And Estate Settlement When Will I Get My Inheritance The American College Of Trust And Estate Counsel

Last Will Testament Templates Poster Template Last Will And Testament Will And Testament Business Letter Template

Oklahoma Estate Tax Everything You Need To Know Smartasset

We Buy Houses Oklahoma Close In 7 Days Any Condition Fast Ca H Easy Sell

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Last Will Testament Templates Poster Template Last Will And Testament Will And Testament Business Letter Template

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Oklahoma Estate Tax Everything You Need To Know Smartasset

Estate Planning Attorney Estate Planning Estate Planning Attorney How To Plan